Starting Your Business

When starting or growing a business there are so many things to know and learn, to name few: taxes, government programs, business culture, credit scores, etc...

Whatever your background, it is challenging to start or grow a successful business in a new country, and we are here to help.

At ISANS, we have a great team of business counselors to support you in every step of the way and can save you time and frustration. They will help you get answers to your questions:

- Questions about Nova Scotia business practices.

- Questions about funding sources.

- Questions about building networks ...and much more.

We put together a comprehensive list of resources to support you as you start your business. We also developed relationships with professionals in all areas of support for entrepreneurs.

Business counselling is a free service offered to ISANS clients with a CLB 5 or higher. You will receive one-on-one support before, during, and after you open your business.

Have an ISANS business counsellor contact you by emailing business@isans.ca or click the link below.

Start Here

Get To Know Yourself

Evaluate whether or not you are ready for entrepreneurship.

You need to explore whether or not you have the necessary passion, skills, and experience to run a business and if you do not, learn how to get these skills. One way to evaluate your readiness is to do a self-assessment.

A self-assessment is an inventory of your previous education, training, experience, skills, knowledge, and interests. It helps you discover what you are good at, what you need to improve on, and what kind of business might be a good fit for you.

Successful entrepreneurs make an effort to recognize their abilities and weaknesses. Will your business allow you to make the best use of your skills? Do you know how to improve your weaker skills or how to hire people who are strong in your weak areas? Can your business afford to pay another person?

If you think you would like to open a business, it is important to consider:

- What you like

- What you do not like

- What you are good at

- Areas you need to work on

Business Ideas

Several factors influence the success of your business including you as the entrepreneur, your finances, and factors outside of your control. However, one of the most important factors is your business idea.

- You have an innovative product or service that does not already exist in the marketplace

- The product or service already exists, but you wish to deliver it in a different way

- The business already exists, and you want to purchase it and expand on the existing idea

- Each of the above ideas has value, and potential for success based on your passion, skills, and experience. You need to decide which is right for you.

The Fit Between You and Your Idea

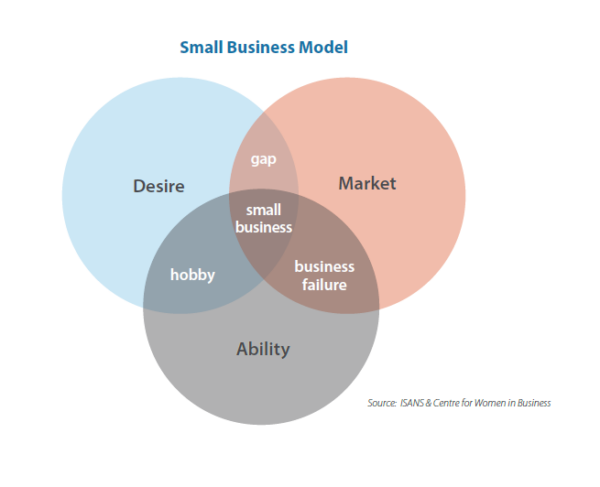

A good business idea must be suitable for you to make it work. Success in business requires a combination of desire, ability, and a good market for your product or service.

- If you have desire and ability, but find your market is too small to turn a profit, consider changing your business idea to a hobby rather than a primary source of income

- If you have the desire and a great market but lack business skills, consider that you may need to train or to hire people who have the skills you need

- If you have the ability and a market but no desire or motivation to run your business, your business may fail

As you generate business ideas, do not limit yourself. An idea that seems impossible may eventually lead you to a good opportunity. So as you generate ideas, keep your mind open to all possibilities. Individuals often start businesses in a field that they know well. It is good to explore alternate ideas and perspectives as you determine the right opportunity for you. Once you have decided on a few ideas, use market research techniques to evaluate them.

Some Questions to Ask Yourself Before You Start Your Business

- Is your business a new idea?

- If others are already operating similar businesses, what is different about yours?

- Do you have any cultural experiences that are an advantage to your business?

- How do you best set up your business to generate the most profit possible?

- Is there a way to ‘test market’ your business?

- What do you need to do to make your idea a reality?

- Is there an existing business available for sale that matches your idea?

Your business plan is a living document. Think of it as a map for starting and running a successful business. Start your business plan as soon as you decide to go into business. Do not expect to complete it entirely until much later on.

Below is a guide to help you create your own business plan.

How Long Should a Business Plan Be?

In general the document is 20 to 30 pages long

- Add a cover that contains your business name, your name, contact information, and date

- Make it long enough to provide a solid overview of everything you intend to do, why you want to do it, how you are going to do it, and what you expect the outcome to be.

What Kind of Language Should I Use?

Use formal language in your business plan. For example:

- Refer to both yourself and your business in the third person as “the owner” and “the business” (avoid the pronouns I and we in the plan)

- Use subheadings in each section to help organize your thoughts and to make the plan easier for other people to understand

- Ensure your business plan is free of spelling, grammatical, and punctuation mistakes

Have someone else review it before you begin to use it. Even the best writers need editors to look over their work.

Business Plan sections

Executive Summary

This section gives a brief overview of your whole plan. Even though it is the first section in a business plan, it is easiest to write it last. It summarizes your entire plan. This section should be no longer than one page.

Table of Contents

The table of contents is a separate page after the cover page and executive summary. It lists all

headings and subheadings and the page on which the reader can find each.

Project Costs and Funding

This section demonstrates specific dollar amounts on how much:

- You expect to spend

- Funding you have now

- You think you will need in the future

Products or Services

- Your products and services

- What makes it special

- Why people will buy from you

- Whether you offer guarantees or warranties on your products or services

- Patent and licensing information as well as any other intellectual property (IP) you may have

Market Share

The market share section states how many people will be interested in your product or service as well as details on your competition and how they will react to your business. It shows how many people might buy your product or service.

- Your clients’ or customers’ needs

- How you intend to catch clients’ attention (for example, through packaging, location, advertising, or a combination)

- Your research into pricing

- Your prices and profit margins

Operational Requirements

This is where you outline what assets you require to operate your business. Identify:

- The type of space your business needs (for example, a storefront, or online)

- Any special requirements such as extra electricity, air conditioning or drainage

- The permits and licenses required to operate your business. For information on what licenses and permits you need, go to BizPal. You should attach copies of the required documents you have obtained in an appendix to your business plan.

Management

In this section, provide information on owners and managers:

- Detail the company structure, such as whether it is a sole proprietorship, partnership, or corporation (more on business structures page 47-50)

- Explain who they are and how their education and experience makes them good candidates for their positions

- For a larger business, show the proposed organization chart of the company, and include a brief job description of each position. For a smaller business with three employees or less, you do not usually need to prepare an organization chart.

Personnel

Include this section if you plan to hire employees. Indicate for each position:

- The job descriptions

- Whether the position is full-time or part-time, and seasonal or temporary

- Skills and training needed

- How you will pay employees (for example, hourly wage or commission)

Financial Projections

This section includes:

- A 3-year cash flow (report detailing the total amount of money being transferred into and out of a business)

- Balance sheet (a statement of the assets, liabilities, and capital of a business or other organization at a particular point in time)

- Profit or loss statement (also known as an income statement, this is a financial statement that reports a company’s financial performance over a specific period)

These documents are standard in Canadian financial reporting.

Appendix

In this section, attach any supporting documentation for your business not included elsewhere in the document. For example, most organizations that give loans to businesses in Canada ask for a copy of your résumé, along with a “statement of personal net worth” with any loan application. A statement of personal net worth is a document, which lists the realistic value of the assets you own, and the debts you owe as an individual rather than related to a business. Find example templates online at no cost.

References

This section includes references from people like your accountant, consultant, insurance company, lawyer, and banker.

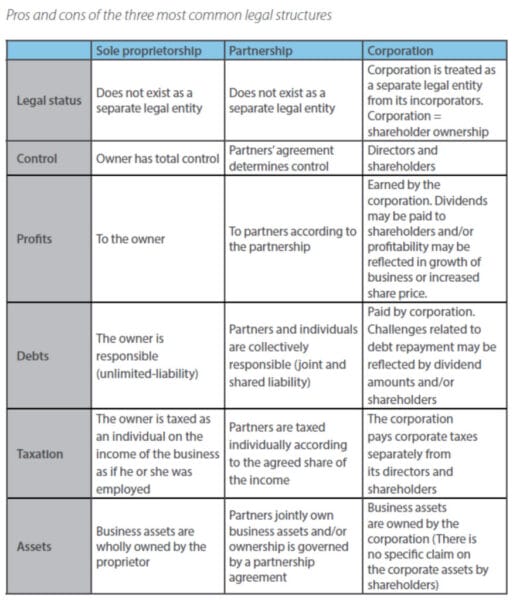

The structure you choose can affect whether your business attracts investors, partners, and other financial backers, as well as how your business grows in the future. There are three main types of business structures in Canada, each with different features:

- Sole proprietorship

- Partnership

- Corporation

It is a good idea to talk to a lawyer who specializes in small businesses before you make a final decision. A lawyer can help you with partnership contracts and articles of incorporation. They can also help ensure you properly register a corporation.

Sole proprietorship

A sole proprietorship means only one person owns a business. If you are a sole proprietor, Canada Revenue Agency views you and your business as one. Your profits from the business become your income as the owner. Also, you are responsible for all liabilities of the business. If, for example, you cannot pay the business’s debts, you must pay the debts from your personal assets.

The advantages to this business structure are:

- You have a straightforward business structure

- The most freedom from regulation

- It is the least expensive for you to set up and has minimal registration requirements

- You have fewer ongoing administration and annual fees

- As an owner, you earn 100% of the profits

- You may be eligible for tax benefits in limited circumstances

- You are the sole decision maker

The disadvantages to this business structure are:

- You are personally responsible for all business liabilities

- Any profits will be considered your personal income in the calendar year earned

- You have fewer options to pay less tax or delay tax payment

- You may have difficulties raising additional capital

Partnership

A partnership is similar to a sole proprietorship owned by two or more people. If you have a partnership, you and each partner share the responsibilities and profits of the business. You each claim your part of the profit on your personal income tax. Each partner is personally responsible for all liabilities of the business regardless of which partner incurred them.

The advantages to this business structure are:

- It is relatively easy for you to set up

- You have lower start-up costs

- All partners contribute money or skills or both

- Partners may be eligible for tax benefits in limited circumstances

The disadvantages to this business structure are:

- You and your partners share control and authority, and this can cause major conflicts in the business

- You and your partners may disagree on important issues (it is a good idea to hire lawyers to make a Partnership Agreement contract)

- Profits are considered personal income, and you may pay higher income tax

- Partners are each personally responsible for all liabilities of the business

- If one of your partners cannot or does not pay their share of owed amounts, creditors can require full payment from you and the other partners

Corporation

A corporation is the most complex of the three business structures. When you incorporate your business, it becomes its own legal entity. It is separate from its owners (called shareholders). Shareholders of a corporation have limited liability. In most cases, liability is limited to the shareholder’s investment in the company.

The advantages to this business structure are:

- As a shareholder, you have limited liability which provides personal protection from creditors

- It may give you greater credibility with customers, suppliers, and lenders

- You gain substantial tax advantages

- Ownership is transferable and survives the death of shareholders (easier for estate planning)

The disadvantages to this business structure are:

- It is more complicated to set up and maintain

- You will need the help of a lawyer or someone with legal expertise

- Its tax rules are more complex, and you will need to access professional accounting services

- There are greater regulatory guidelines which require additional accounting, banking, and administration costs

Other

A co-operative is another legal incorporation structure. In a co-operative, you and a group of people start a business together to meet a common need or to maximize a common opportunity. You must operate on the same principles as any other business structure. A co-operative is democratically controlled (based on one member, one vote), has an open and voluntary membership, and distributes profits as patronage dividends.

There are 3 types of organizations you can use with the intention to achieve something other than profit:

- A charity is an organization that must use their resources for specific charitable activities, such as to support those who live in poverty

- A not-for-profit, or non-profit, is an organization which exists to serve a purpose other than generating profit although it may do so as part of its activities. These are often community initiatives, such as an organization formed to manage a local community center

- A social enterprise is a revenue-generating business with primarily social objectives. The enterprise reinvests surpluses for its primary social objectives in the business or the community, rather than by the need to deliver profit to shareholders and owners. Another name for a social enterprise is a Community Interest Company or CIC.

As you prepare to open your business, you must choose a unique name. A business name consists of three main parts:

- A distinctive element (something memorable that helps your business name stand out from others)

- A descriptive element (so that people can tell from your name what the company does)

- A corporate designation (only if your company is incorporated, e.g. Ltd.)

Create a list of business names. The name you want to use may already be registered. Note: a company name may differ from the product name(s).

Tips to choose a business name

- Your name should be easy to pronounce in the language of your target market

- Your business name should describe the services you offer

- Choose a short name that is easy for people to remember

- Your name should distinguish you from your competitors

- Canadians do not always name businesses after themselves or their family members (check to see what the standard is for your type of business)

Once you decide on your business name, contact the Registry of Joint Stock Companies (RJSC) to register your business. You must conduct a name search at this point to make sure that no one else uses the name you selected.

Apply to reserve a name here:

https://beta.novascotia.ca/reserve-name-your-business-or-non-profit If the Registry of Joint Stock Companies approves the name for your use, you can register or incorporate your business.

Registration takes a couple of days. If your name is not accepted, you have to choose a different name and go through a name search again.

If your name is accepted, continue with your registration: fill out the forms provided by the RJSC (they are available online), submit them, and pay the fees. The RJSC will mail you a Certificate of Registration.

Once you have chosen an available name for your business, you should register it with the government. When you register your business, you receive a nine-digit Business Number. You require this number to pay taxes, apply for licenses, and import or export goods.

If you plan to have other Canadian business locations outside Nova Scotia, follow the procedures to register your business in that region.

Every type of business in Nova Scotia has its requirements for permits and licenses. Ensure that you are adequately prepared to deal with the government, other businesses, and the Canadian public.

Early in the business development process, discover which permits and licenses you require for your business. BizPal is an online, searchable directory for business permits and licenses. BizPal takes you through a series of questions about the nature of your business, and provides a complete and personalized list of permits and licenses you may need to obtain, based on your responses. For more information, visit www.bizpal.ca

Business Navigators is a service provided by the Provincial Government of Nova Scotia that can also provide information about permits and licenses.

https://novascotia.ca/regulatoryopportunity/business-navigators.asp

BusNavigation@novascotia.ca or 1-844-628-7347

Municipalities process zoning requirements, signage regulations, occupancy permits, development permits, and fire prevention inspections.

https://www.halifax.ca/home-property/building-development-permits

Halifax Regional Municipality:

contactus@311.halifax.ca or Dial 311 or 1-800-835-6428

First Aid training Workplace Hazardous Materials Information System (WHMIS) training information on violence in the workplace and, smoke-free places to name a few

https://novascotia.ca/just/regulations/regs/ohsworkplace.htm,

If you intend to have 3 or more employees, it is mandatory to register your business with the Workers' Compensation Board of Nova Scotia and pay premiums. If you are interested in coverage for yourself, contact the General Inquiry Line at 1-800-870-3331 to discuss your options.

http://wcb.ns.ca/Workplace-Injury-Insurance/Do-I-Need-to-Register.aspx

The Nova Scotia Labour Standards Code sets minimum employment standards for most provincially regulated businesses in Nova Scotia. There are a number of topics included in the Guide to the Nova Scotia Labour Standards Code and how they might relate to you.

http://www.novascotia.ca/lae/employmentrights/docs/labourstandardscodeguide.pdf

Helpful Tools

- Atlantic Canada Opportunities Agency

- Canadian Intellectual Property Office

- CyberSecure Canada

- Global Affairs Canada

- Innovation Canada

- Scientific Research & Experimental Development

- Immigration, Refugees and Citizenship Canada

- Natural Sciences and Engineering Research Council of Canada

- Business Development Bank of Canada

- Export Development Canada

- National Research Council of Canada Industrial Research Assistance Program

- Procurement Assistance Canada

- Women and Gender Equality

- Canada Fisheries and Oceans Canada - Atlantic Fisheries Fund

- Invest in Canada

Market Research

Learn About Market Research

Market research is an opportunity to gather information on how potential buyers will react to your current or prospective products and services. Complete market research is critical for new start-ups and should be a key element of your business plan.

The goal of market research is to equip yourself with the information you need to make informed business decisions about start-up, innovation, growth, and the four Ps: product, price, placement, and promotion.

Product

Improve your product or service based on what your customers want and need.

- Function - how can your product or service be more effective?

- Appearance - what would make the image of your product or service more appealing?

- Customer service or warranties - how can you add value to your product or service through the support you offer for it?

Price

Base your price on one or a combination of:

- Popular profit margins

- Competitors’ prices

- Financing options

- The price a customer will pay

Placement

Decide where to set up and how to distribute a product. Compare the characteristics of different locations and the value of points of sale (retail, wholesale, and online).

Promotion

Figure out how best to reach your particular market segments (teens, families, students, professionals, etc.) in areas of advertising and publicity, social media, and branding. Then create your value proposition, the statement that details how your product or service will add value to your customers, or solve their problem better than a competitor’s offering.

Market research helps you avoid unpleasant surprises. Intuition and experience can be helpful at times, but research and facts present a more accurate picture of your market. This is particularly important if you are new to Canada. There may be differences in the market to what you expect.

Get to know your customers and competitors. It is important to find out as much as you can about the people you want to sell to, the competition you might face, industry trends, and your potential market share.

Research the Customer

The first thing you need to do is to consider whether the market wants or needs your product or service. Once you have done this, see if others agree with you. You could ask a group of potential customers, or your ISANS business counsellor.

- Who will buy your product or service?

- Where do they live?

- What are they like (age, gender, do they have children, etc.)?

- Why would they buy your product or service?

- How often would they buy it?

- Where would they buy it? At a store, or market, or online?

- Do your buyers have preferences towards your product or service?

- Will you be able to build customer loyalty for your brand?

- What sort of image do you want your product or service to have?

Research the Competition

You also need to research your competition. To get information on the types of businesses that operate in your area, try an online search. Contact organizations with access to databases that list companies by location and services (the Canada Business Network has several that are available for free). Databases help you collect information, but you have to interpret the information yourself.

For example:

- Who are your competitors?

- What are their strengths and weaknesses?

- How do you compare to them?

- How do you think they will react when you open your business?

- Will people purchase your product or service from a new source or are they already loyal to another business?

- Does your business already have goodwill?

Reliable market research information – Access research on the topics you need:

- Demographics (e.g., age, household income, marital status, etc.)

- Potential competitors

- Suppliers and distributors

- Industry performance

- International market and industry data

- Financial benchmarking specific to your industry

- Consumer trends

- Import and export statistics

If you need help with Market Research, ISANS refers you to:

ACOA Business Information Services

Cindy Allen

Communications Officer

902-426-6286

1-877-456-6500

cindy.allen@canada.ca

Financing and Accounting

Under review:

- CEED - Centre for Entrepreneurship Education and Development

- Canada Digital Adoption Program

- Innovation Canada - Funding search tool-Business Benefit Finder

- Halifax Partnership Why Halifax incentives

- NSBI - Funding Search Tool

- MSVU – Mount Saint Vincent University - Funding programs

- BBI - Black Business Initiative

- CBDC

- Communities, Culture, Tourism and Heritage

- ARTS Nova Scotia

- Visual Arts Nova Scotia

Types of Taxes

Personal Income Tax – A tax on an individual’s income paid to the government, business-related income, and investment income. Personal income also includes pension income, income from rental properties, and capital gains.

Corporate Income Tax – A tax that a corporation has to pay to the government, based on the corporation’s net income.

Harmonized Sales Tax (HST) – A tax on the selling price of goods and services. If you are self-employed, these taxes can be recovered by claiming input tax credits (ITCs). How often you have to file taxes?

- You must file a personal tax return every year for the previous year

- Every year, the file-by-date is midnight, April 30

- Business owners who are self-employed, and their spouses, are required to file an annual income tax return by June 15

- If you owe tax, you must pay it by April 30, even if your filing deadline isn’t until June 15

- If you owe more than $3,000 in any year, you may be able to pay it in four instalments, due on the 15th day of March, June, September, and December

- If you do not pay your taxes on time, you will incur interest and penalties

How and Where to Report Taxes

Canada Revenue Agency (CRA) collects taxes and administers laws for the federal government and most provinces and territories.

To file your taxes, you need the General Income Tax and Benefits package from CRA. The package includes a guide, tax return, related schedules, and provincial schedules. There are several ways to get your tax package: online, by phone, or in person at CRA offices and Canada Post outlets during the filing season.

All corporations that do business in Canada have to file a T2 corporate income tax return each tax year, even if there is no tax owing. The only exception is a registered charity. Registered charities must file an annual information return. Visit www.cra-arc.gc.ca or call 1-800-959-5525.

Harmonized Sales Tax (HST)

HST stands for Harmonized Sales Tax, a tax on the sale of goods and services. It consists of two tax rates combined: the 5 percent federal Goods and Services Tax (GST) and the 10 percent Nova Scotia Provincial Sales Tax (PST).

When your business has sales of taxable goods and services of more than $30,000 you will need to register your business with CRA for an HST/GST account. See the requirements of the Small Supplier requirements to determine when your business will be required to register, visit: www.canada.ca/ en/revenue-agency/services/forms-publications/publications/rc4022/general-information-gst-hst-registrants.html#H2_206If your revenue does not exceed $30,000, you can choose not to register for HST. In that case, you are not obliged to charge HST for your products or services. However, you must pay HST on goods and services that you purchase for your business. Not charging HST means your customers pay lower prices. On the other hand, you cannot claim any HST that you paid to buy your business.

How to Register for HST

When you registered your business (see Section 4), you received a nine-digit business number. When you register for HST, you receive a 15-digit number that is the same first nine digits of your business number, with the addition of two letters and four numbers at the end.

If you operate a Canadian business and registered for the HST, you can claim Input Tax Credits (ITCs) for the HST you have paid for business purchases. This may result in a refund.

To claim ITCs, you must register with the CRA to collect HST although you are not required to do so unless sales revenues are greater than $30,000.

Once you register for HST ITC refunds, you have to charge HST on anything from which you earn revenue by selling goods or services.

You must keep accurate records of your claimed ITCs. You must also keep accurate records of sales, expenses, and HST collected.

Although you can make claims for ITCs without sending any documentation or receipts, you must keep supporting documents in case of an audit.

All receipts must show the vendor’s name, the date, the amount of HST, the vendor’s 15-digit HST number, the method of payment (cash, cheque, credit card, etc.), and a description of the items purchased.

Charging HST can help you survive the start-up phase of your business.

The period when a business spends more money than it generates is called the start-up phase. Save all your receipts for equipment purchased and other costs that you might have. This means that ITCs can contribute to the cash flow of your new venture. Business expenses that generate ITCs include:

- Goods for resale

- Advertisement costs

- Equipment such as furniture, vehicles, and computers

- Operating expenses such as rent, utilities, office supplies, and equipment rentals

Specific Industry Resources

Industry Resources

https://novascotia.ca/regulatoryopportunity/business-navigators.asp

The Business Navigator Starter Guides explain the process for opening some types of businesses.

-

- Accommodations and Campground Starter Guide

- Automotive Repair Garage Starter Guide

- Construction Starter Guide

- Convenience Store Starter Guide

- Farming Starter Guide

- Food Establishment Starter Guide and Inspection Guide for Food Establishments

- Home Prepared Low Risk Baked Goods Fact Sheet

- Meat Plant Starter Guide

- Micro Brewery Starter Guide

- Mobile Food Starter Guide

Training

ISANS business training workshops and seminars help newcomers start and grow a successful business.

Our training sessions are usually 2 hours long, and can be on any of the following topics:

Buying and Selling a Business

In this session, you will learn:

- Small business statistics

- How long it takes to sell or buy

- How to evaluate a business and increase its value

- The challenges you may face as a buyer or seller

- The role of an intermediary

- Steps to take to buy or sell a business

- The reasons owners sell and what buyers look for

Introduction to Taxation and Business Matters

In this session, you will learn:

- GST/HST basic

- Business income tax for self-employed businesses

- Business income tax for corporations

- Import & Duty

- Employment & Payroll

- Contractors

- And more…

The Basics of Business and Employment Law

In this session, you will learn:

- The difference between provincial and federal labour standards

- The basics of human rights, as well as occupational health and safety legislation

- Employment contracts and why employers should have them

- The difference between independent contractors and employees

- Compliance with minimum employment standards

- The importance of record-keeping

- The benefits of using a written employment contract

- The duty of accommodation in the workplace and what is required under this duty

Legal Basics for Businesses

In this session, you will learn:

- How to start a business in Nova Scotia

- Business structures

- The differences between sole proprietorship, partnership, and incorporation

- Permits and licenses

- Taxation of businesses

- Business planning

- Financing your business

Entrepreneur Success Stories

During this session successful entrepreneurs from Nova Scotia will share their entrepreneurial stories! Join these sessions to learn how they started, what their journeys were like and about the challenges they overcame to find business success.

To join this program, you must:

- Be a recent citizen, permanent resident or approved to immigrate

- Be a registered ISANS Business client

- Have a minimum Canadian Language Benchmark of 5 (CLB 5)

Are you a newcomer entrepreneur? Are you interested in starting your own business?

If so, join us for this self-directed, online course! In just 12 to 24 hours, this course gives an overview of everything you need to know to start a business in Canada.

Course Topics:

- Business plans and bookkeeping

- Canadian business culture and networking

- Business structures

- Registration and zoning, licenses and permits

- Banking, credit, and funding considerations

- Taxation and business insurance

- Employee regulations / labour standards

Technology Required:

- Latest version of one of the following browsers is recommended: Firefox, Safari, Google Chrome or Internet Explorer

- Email: Outlook Express / Outlook / browser-based package, i.e. (Gmail, Hotmail, Yahoo)

- Operating System: Windows XP or higher, Mac OS X or higher

- Latest version of Java and Adobe Flash

- Headset or Speakers

- PDF reader (such as Adobe Reader)

- High speed internet access

Recommended Language Level:

- Canadian Language Benchmarks (CLB) 5 or higher (Intermediate)

- General/Academic IELTS: 5.5+ in all skill areas

How to start a business – Pre Launch:

- How to start a business - Pre-Launch (video)

- How to start a business- Pre-Launch (PDF)

- How to start a business- Pre-Launch Checklist (PDF)